Here you will find the list of 8 best budget planner apps for iPhone and iPad for 2025. These apps allow you to create budgets and track expenses right on your iOS device.

In a world where our pockets are continuously drained by impulse online shopping and the irresistible allure of avocado toast, it’s high time we bring in some reinforcements to whip our finances back into shape.

Thankfully, the glorious era of smartphone apps is here to save the day and our bank accounts! Say goodbye to budgeting blues and hello to a brighter, wealthier future with the best budget planner apps.

Best Budget App for iPhone

The top-notch personal finance applications offer a range of features to effectively handle your financial matters. These encompass email notifications, bill deadlines, subscription tracking, shared wallets, and additional functionalities. What sets these apps apart is their compatibility with both iOS and Android, enabling you to make the most of them regardless of your smartphone choice.

Here are some of the spending tracker apps that would help you manage your money matters with just a tap!

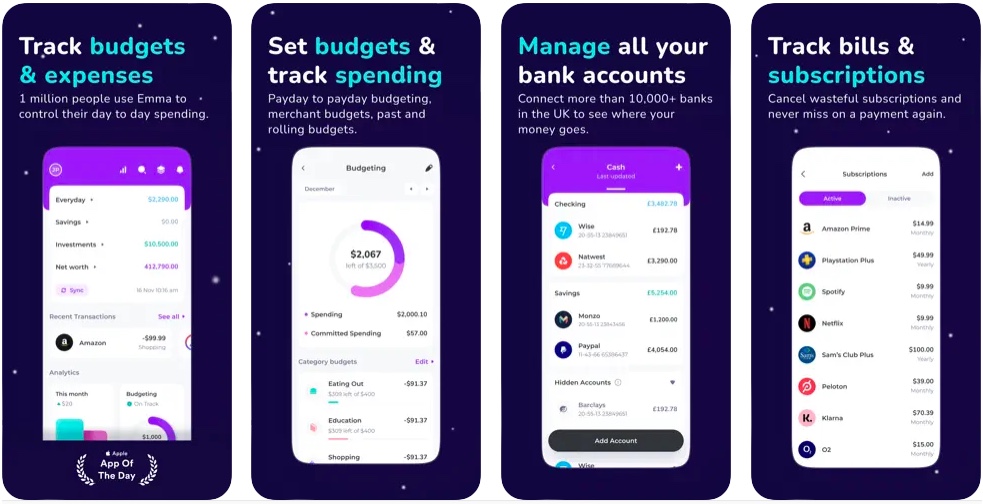

1. Emma – Budget Planner Tracker

This incredible app is your go-to solution for effortlessly handling your finances. With its sleek and user-friendly interface, managing your budget and tracking expenses has never been this simple. Whether you’re dreaming of that dream vacation or just want to stay on top of your spending, Emma is here to make it happen.

Emma offers a range of powerful features that will revolutionize the way you manage your money. Say goodbye to the manual categorization of expenses because Emma automatically takes care of it for you. It understands your spending patterns and neatly organizes your expenses into categories, saving you time and effort.

But that’s not all! Emma also lets you create personalized budget plans tailored to your financial goals. Whether you want to save more, reduce debt, or increase investments, Emma has got your back. You’ll receive smart recommendations and real-time insights to help you stay on track and make informed financial decisions.

Emma goes beyond just tracking expenses. It also keeps an eye on your investments, making sure you stay updated on their performance. With Emma, you can effortlessly monitor your investment portfolio and make informed decisions to grow your wealth.

Install Emma – Budget Planner Tracker from the App Store now

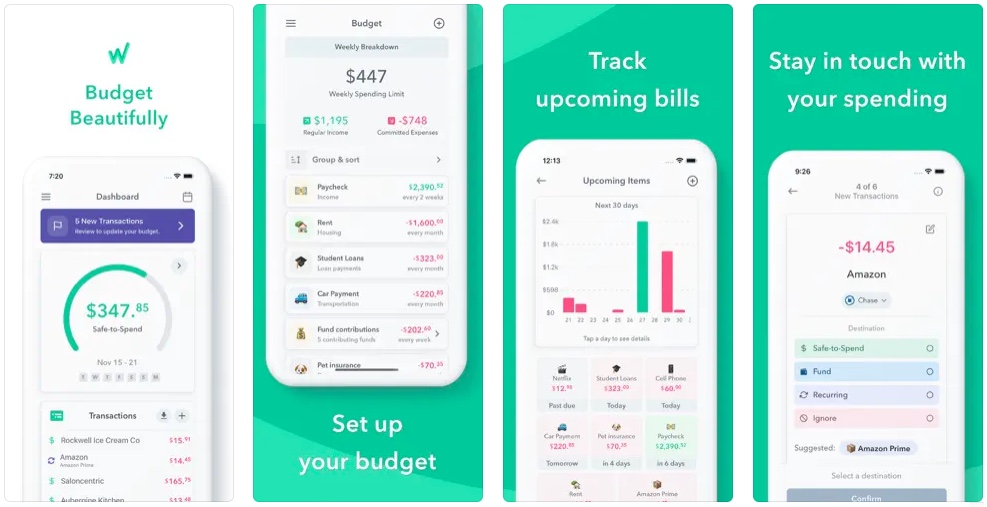

2. Weekly: A Better Budget App

With its user-friendly interface and hassle-free setup process, Weekly makes it a breeze to create and maintain a personal or household budget. No more complicated spreadsheets or hours of number-crunching. We’ve got you covered!

Not only can you track your regular expenses using our handy spending tracker, but you can also set up separate funds for all your saving goals. Dreaming of that tropical vacation? Saving up for a down payment on a house? Need to prepare for emergencies or special occasions like birthdays or holidays? Weekly has got your back!

Here’s the best part: Weekly syncs seamlessly with your bank account, automatically fetching your transactions. And the app takes care of all the calculations for you. No more manual inputting or dealing with complex math.

By breaking down your budget on a weekly basis, Weekly helps you gain a whole new level of clarity. You’ll be amazed at how much simpler it becomes to understand what you can afford to spend while still saving money for your goals. Plus, if you’re sharing finances with a partner, Weekly allows both of you to stay on top of your “Safe-to-Spend” amount together.

Install Weekly: A Better Budget App from the App Store now

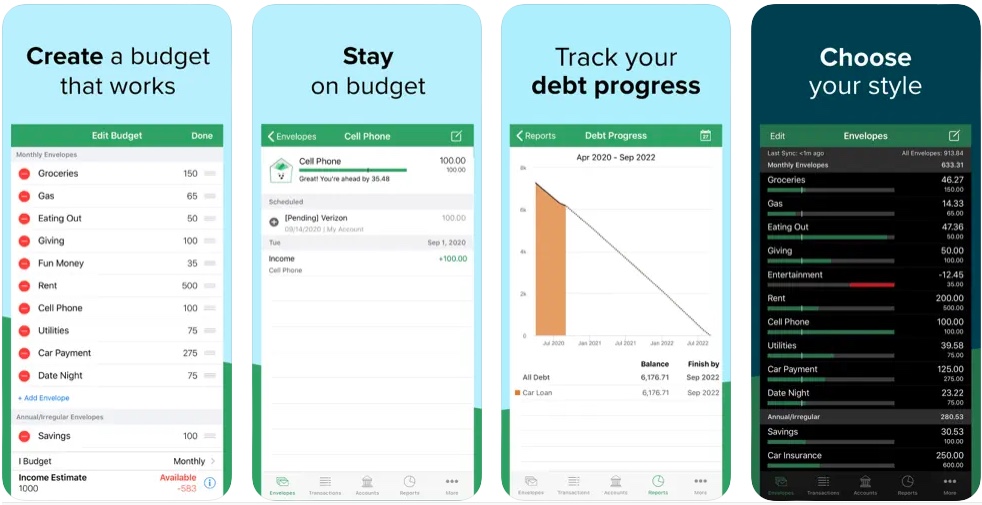

3. Goodbudget Budget Planner

Goodbudget is the ultimate personal finance app that’s here to help you with budget planning, debt tracking, and money management. It’s like having your very own financial advisor in the palm of your hand!

One of the standout features of Goodbudget is its seamless budget-sharing capability. Whether you want to collaborate with your spouse, a family member, or a friend, Goodbudget makes it super easy. You can sync your budget across multiple devices, including iPhones and other smartphones, and even access it on the web. No more confusion or misunderstandings about your finances – you’ll always be on the same page as your loved ones.

With Goodbudget, your financial data is securely backed up to their website automatically. This means you can breathe easily, knowing that your important information is safe and sound. Plus, you can conveniently download your transactions to a CSV file directly from the website for further analysis or record keeping.

But that’s not all! Goodbudget also provides you with powerful in-app reports to make sense of your budgeting and spending. These reports give you valuable insights into your financial habits, empowering you to make informed decisions. Whether you want to modify your budget, track your debt payoff progress, or see a breakdown of your spending through a cool-looking pie chart, Goodbudget has got you covered. And if you want even more reports, you can access them on their user-friendly web platform.

Install Goodbudget Budget Planner from the App Store now

4. Buddy: Budget & Save Money

Meet Buddy, your go-to buddy for all things budgeting and saving money. Whether you’re flying solo or tackling finances with your loved ones, Buddy is here to lend a helping hand.

With Buddy by your side, you can bid farewell to overspending on your hard-earned salary. You and the app can work together to create a personalized budget plan that perfectly suits your needs. Looking to share expenses with your partner? Planning a group vacation and want to keep things fair? No worries! Just invite them to join, and Buddy will provide a clear breakdown of who spent what.

Connecting your bank account to Buddy allows you to effortlessly import all your transactions. That way, you can easily keep tabs on your budget’s progress. The app has a sleek and detailed overview that shows exactly how much you’ve spent, how much you’ve earned, and even how much you’ve saved.

But that’s not all! Buddy’s Split feature ensures that you stay on top of shared expenses. It keeps track of who paid for what and provides guidance on how to settle up smoothly.

Install Buddy: Budget & Save Money from the App Store now

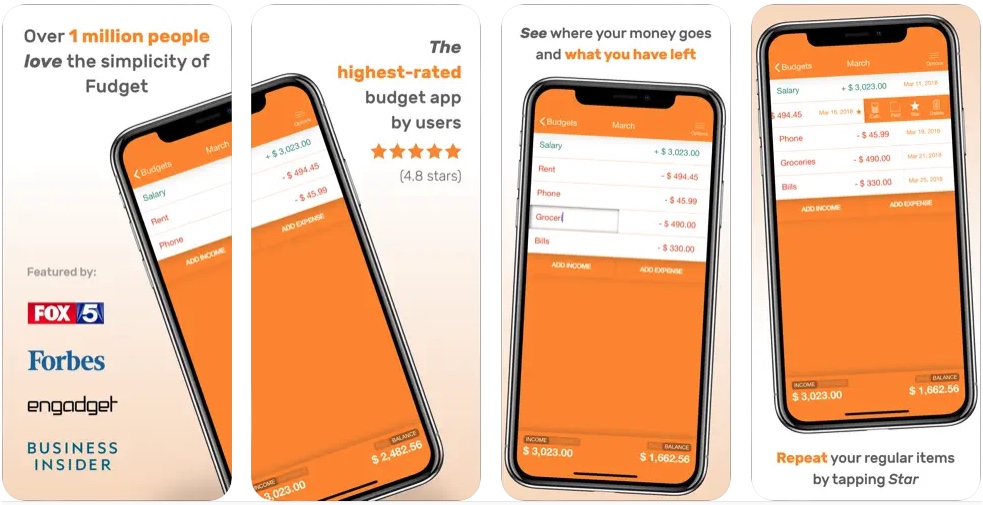

5. Fudget: Budget Planner Tracker

With Fudget, you can create straightforward lists of your income and expenses, allowing you to easily keep track of your balance. The intuitive interface makes it a breeze to navigate, and you’ll find yourself familiar with it in no time.

Adding and editing items is as simple as a single tap. Plus, you can start an income or expense to automatically include it in future budgets, saving you time and effort. Whether you prefer to budget on a monthly, weekly, or custom schedule, Fudget has no time constraints, allowing you to use it however you like.

To make organizing your finances even easier, you can drag and reorder items to arrange them according to your needs. Additionally, you can mark an expense or income item as “paid,” giving you a clear view of your paid items and their impact on your overall balance.

Fudget offers flexibility when it comes to currency symbols. You can choose from a variety of options or even set your own custom currency symbol, ensuring that your financial information is displayed in a way that makes sense to you.

To keep your data secure, Fudget provides multiple layers of protection. You can set up a passcode lock and login system to prevent unauthorized access. For added convenience and security, the app also supports Touch ID login, allowing you to use your fingerprint to safeguard your app and data.

Give it a try and experience the peace of mind that comes with effortless money management.

Install Fudget: Budget Planner Tracker from the App Store now

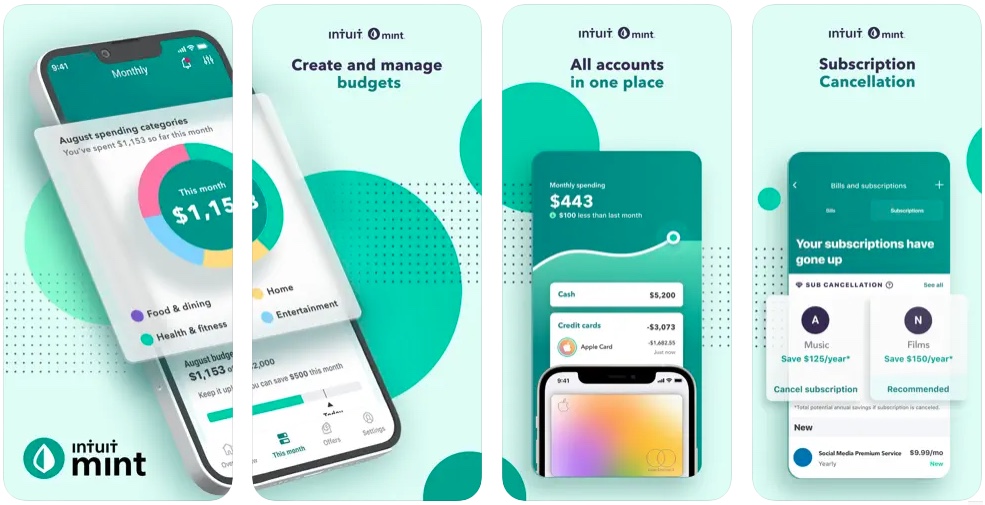

6. Mint: Budget & Expense Manager

Mint revolutionizes money management by consolidating all your financial information in one convenient place. From account balances and budgets to credit health and financial goals, everything you need to know about your money is right at your fingertips. With Mint, you gain a comprehensive understanding of your financial well-being, including account balances, monthly expenses, spending habits, your free credit score, net worth, and more. Connect all your cash, credit cards, loans, investments, and other financial accounts for a complete picture of your financial health.

Tracking your transactions, budgets, expenses, and subscriptions has never been easier with Mint. The app brings together all your financial data to show your net worth and highlight spending trends. Receive alerts when you’re nearing your budget limit or about to overdraw from an account. Mint will also notify you when subscription prices increase and identify unused subscriptions that you can cancel.

Install Mint: Budget & Expense Manager from the App Store now

7. Spending Tracker – Budget

Introducing Budget Card, a fantastic personal finance app that helps you track your spending, plan your budget, and save money. And the best part? It’s completely free to use, with no annoying ads or invasion of your privacy.

With Budget Card, you can effortlessly set up both recurring and one-time budgets. Just tap a card, enter the desired amount, and you’re done! The app conveniently records your budget right in the notification center, making it a breeze to stay organized. Whether it’s managing your transactions, or keeping track of repeat payments, subscriptions, or installments, Budget Card has got you covered.

Need to keep an eye on your day-to-day spending? No problem. Budget Card offers a convenient calendar view that displays all your expenses, so you can easily monitor where your money is going. Plus, you’ll have access to insightful stats and charts that show your spending trends, composition, and much more.

But it doesn’t stop there! Budget Card allows you to manage multiple accounts, including credit cards, debit cards, mutual funds, and stocks. You can effortlessly track your spending and manage your budget, all while collaborating with others seamlessly.

So why wait? Start taking control of your finances with Budget Card today. Download the app and experience the ease and convenience of tracking your spending, planning your budget, and saving money like never before.

Install Spending Tracker – Budget from the App Store now

8. Moneon – My budget & expenses

Say goodbye to limitations, as Moneon allows you to create an unlimited number of wallets. Set budgets for your entire wallet or specific categories and subcategories, giving you the flexibility to allocate funds where they matter most. Plus, you have complete control over category and subcategory creation, tailoring your budget to suit your unique needs.

Stay on top of your financial progress with the quick overview provided on the summary page. See your current period at a glance, empowering you to make informed decisions about your spending. Moneon also offers support for popular currencies, so you can manage your finances regardless of where you are in the world.

Your data is safe and secure with Moneon. Automatic backups ensure that your financial information is never lost, while password-protected access, including support for Touch ID and Face ID, guarantees that only you can access your data.

Need quick access to your financial information? Moneon’s widget for the Today screen keeps your most important details just a swipe away, giving you instant updates on your budget and expenses.

Designed with Apple’s guidelines in mind, Moneon boasts a sleek and intuitive interface that is both visually appealing and user-friendly. Plus, you can even use voice input to effortlessly enter your expenses on the go.

Install Moneon – My budget & expenses from the App Store now

To Conclude…

The year 2025 has witnessed remarkable advancements in apps to track budget, empowering individuals to take control of their finances like never before.

From intuitive interfaces and powerful features to seamless integration with banking systems and expense tracking, these apps have revolutionized the way we manage our money. Whether you’re a student, a professional, or someone striving for financial stability, the best budget planner apps for iPhone offer a range of options to suit your needs and preferences. With their user-friendly interfaces and comprehensive tools, these apps provide the necessary guidance and support to help you achieve your financial goals, paving the way for a more secure and prosperous future.

Embrace the power of technology, download one of these iPhone budget apps, and embark on a journey toward financial success today.